A summary and suggestions for improvement of some of the trades as seen on CNBC Options Action

Sunday, February 23, 2020

$LOW Options Action trade alternative

23feb - mike and carter with the trade on Lowes, earnings Wednesday before the bell. here is the video clip LOW clip i dont follow Lowes directly but Home Depot is on my watch list. mike essentially with a diagonal spread

Buy the Jun 125 call

Sell the Feb 132 call

net debit of $6.57 for a one lot

thesis was that the weekly option pricing is elevated because of earnings, thus buy the Jun 125 which is at the money. best outcome is that stock moves up to near 132, the Feb options expires worthless and the Jun option gains in value. 132 being about at the expected move. ok, makes sense. then again its just not my style to buy at the money options nor spend $657 for a directional trade. too pricey for me. obviously if stock moves down from earnings or overall market the trade is a loser. so you need an up move.

my preferred trade if going directional is a calendar spread. but the Feb28 /Jun 130 is still over $3 debit. next up is a butterfly, mike chose 132 being near the top of the expected move so i will use that strike as well. again trying to be cheap so if im wrong its just a few bucks, under $100 ideally. so given the assumption that stock moves up and is near the expected move of 132 at end of week the Feb28 129/132/135 call butterly priced out at .36 for a one lot. a 3 lot gets you to $100 max, which is also your max loss, max profit on the 3lot with at 132 pin is near $800. profit zone at opex is 129-135 , if stock moved up after earnings on Wednesday morning i would exit this at about $1.00-$1.50 if i could and take the 3x-5x win and move on to the next one, if youre going to roll the dice and try for that 132 pin at least sell enough prior to get your initial debit back. I would rather risk .36 vs $657 if im wrong. risk less make more. 3 bags full. note that the stock is near 52week high now so 132 well above . enter this trade Tuesday based on where the stock is trading at that time.

Monday, February 17, 2020

$USO Options Action alternative trade

15 feb - mike with the trade for USO and Carter with the charts. pretty straightforward. Buy the Apr 11.50 call for .30 on a play that oil rebounds a bit. here is the video clip USO clip

as mike said the USO was just over 13 couple weeks ago. this segment got me looking at a couple of different trades. in general its rare that I buy an upside call, preferring to be a premium seller. but also along with most people thinking that oil will rebound at some point after the corona virus has run its course or a geopolitical event.

I first looked at my go to trade of buying a DITM call from jan2022 and selling a nearer month upside call. but not wanting to lay out a lot of cash to do so.

Second trade I looked at was doing a calendar spread based on mikes thesis. as in sell a nearer 11.5 to buy that Apr 11.5. but the IV difference between a Mar and Apr 11.5 is nearly zero so unless the thesis is that USO move up but not over 11.5 at Mar opex to expire worthless but Apr 11.5 increases in value, youre not getting the front month decay as hoped for with calendars.

Lastly looked at a Super Calendar using the Apr / Jan2021 , with the intent of letting the short front month reduce the cost of the long call in Jan2021. example:

(after hours pricing)

Sell the apr 12call at .20

Buy the Jan21 12call at .85 for net debit .65.

thesis is to let the Apr12 expire worthless and resell a May/Jun 12 or 12.50 to continue to reduce the cost basis of the Jan21 calls for the move back towards 13.

.65 is not much of a debit for a one lot / $650 for 10 lot . my history with calendars is that many times the stock move up faster than expected and thru my front month short strike so I end up closing the entire trade much earlier than expected since im not gaining anymore if the stock goes thru the short call (lose on the front month short call while gaining on the longer term call). point being I first looked at the 11.50 level strikes for this. debit is a few cents more but im agreeing with mikes thesis that it does a rebound short term. but went with 12 strikes. personally think the better rebound comes later in year. Might actually put this trade on. see how it prices out in the morning.

The Most Useless Options Action segment ever $TSLA

hard to put into words as to how useless this segment is /was. Chalk it up to a video version of Click Bait. I don't watch CNBC during the day except the occasional Fast Money halftime and the Fast Money podcast replay in the evening (not watching/listening to CNBC during market hours has significantly helped my trading ive noticed, I get better info from my twitter stream, plus some porn.. wait, what?), so I chalk this useless segment up to trying to get eyeballs for the show since they will cover TSLA.

here is the link to the video clip Tesla clip

so number one, Tony discusses a trade he saw on TSLA.. which Is cool and all but its for the weekly options...as in they expire "tomorrow" being Saturday 15Feb and the show is filmed after hours Friday. which means the options have ceased trading, ie the viewers can not follow along.

secondly, the "trade" is a 680/675 put spread for .75cents. granted the trade may have crossed in the morning and clearly was hail mary lotto type trade for the stock to sell off during the day. didn't have to drop all the way to 680 but a rapid selloff lets say half way to 730 and the "spread" will pop. unclear if that's what the thesis was or was it risk .75 ($70000 per Tony) to make $4.25 ($400000). doesn't seem like a "smart money" type trade on day of opex. point being is this the type of trade to throw out there to the viewers. of all the things to cover. might as well have just said, "hey guys I saw this trade cross today on TSLA, you cant do it yourself because the market is already closed, but we needed to fill 1:30 minutes of air time".

but if you think about it maybe this trade was brought on by a previous TSLA segment , I think it was last week where mike gave the example of the 800weekly call being .05, then next day over $100 and then going out worthless. wonder how many viewers were lured into that to buy the super cheap options for lotto plays. hope not

would have rather the show spent a minute reviewing mikes previous TSLA trade

personally I have an alert set at 750 to get me to pay attention and another at 735...735 gets me looking at a Put sale with best case at or below the 50 day near 530area. technicals might not matter but its something to shoot against.

Sunday, February 9, 2020

FOLLOW UP #2 to going from bad to worse $TSLA Options Action trade update

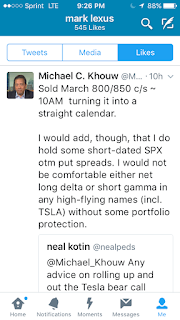

24 feb - damn son.. the old bait and switch. after all that below. i see this tweet today that instead of the trade mentioned to followers and then referenced on the show, this trade was entered TODAY

im sure some followers/viewers were surprised to see this come across. some im sure went ahead and did as recommended and sold the Mar900/950 call. not cool man. so if you did nothing..the original Feb800/850 call credit spread was exercised on you over the weekend resulting in max loss of about $36 ($3600) per lot AND if you did not follow his tweet AND just saw todays tweet and went ahead and sold the Mar800/850 call credit spread, was about $23 credit when i looked earlier ($2300 credit).. so again a $1300 loss from the roll.

now best case need stock to drop below 800 at Mar opex. im going to keep watching to see what other slight of hand surfaces.

------------------------------------------------------------------------------------------------

23feb - i don't "watch" Options Action, i listen to the podcast over the weekend and see the video clips from OptionsAction on twitter that i link to on these blogs which is why i missed this.. turns out the show did have a quick hit on this TSLA trade and the end of the segment where Tony talks his winning DPZ trade. the TSLA clip is not on twitter so i missed it and the DPZ clip ends prior to TSLA comments. but after "hearing" it today im even more pissed / disappointed. mike essentially mentioning that he tweeted the roll to the Mar 900/950 call credit spread. saying the Feb spread expired. NOTEABLY ABSENT was mentioning that the spread expired at Max Loss and that selling the Mar900/950 essentially costs you $3200 per lot. like i said below " but this advice is vague , slightly misleading, or at best- selective on the information disseminated." could really be more transparent. too bad since i like mikes well thought out trades and cool demeaner vs Nathan always being Debbie downer. the takeaway is what ive been doing the last 10years with Options Action. use the trade suggestions as an idea generator / strategy generator. for instance at the end of the SPCE clip (not included on the twitter version) Tony talks about how he has been selling Puts to finance Jan2022 long calls. that was interesting and got me looking at pricing..good idea. didn't follow but good idea regardless. don't follow the trades just because they are on air. their performance is on par with yours. its your account

-------------------------------------------------------------------------------------------------------------------

22 feb im not often surprised until this trade. start from the bottom and read the updates so far. i spotted a few people on twitter that followed along and did this trade and mike responded as such on Friday:

note the viewer is also mentioning that a roll is going to be a healthy debit. so mike is going to roll to the Mar900/950 call spread...seems simple enough but what is not being mentioned is the crazy price. has the short Feb 800/850 call spread (as in needs stock under 800 to get max profit, remember stock was 750 at trade entry).. so to roll to the Mar900/950 the Feb800/850 has to be brought back for $49ish and then the Mar900/950 call spread sold. this roll costs $32 debit ($3200)..that's nuts. stock is at 900 now so need stock to be under 900 at Mar opex to get full value of the call spread. subtract the roll $32 so really need under 868 to be breakeven on just the roll. that 868 area is about a 61% delta meaning a 61% chance that stock is ABOVE 868 at opex, so to breakeven on just the roll needs a 39% event to happen.

because the Mar900/950 call spread is not bringing in enough premium to cover the max loss of the Feb 800/850 spread is causing the huge debit

My Option #3 from below to just close out the whole thing for a $23 debit ($2300) and move on. i cant understand the logic off SPENDING EVEN MORE than this exiting amount just to keep in the trade because now you have spent $32 to roll plus the original $3+ to enter=$35. leaves you with a potential max profit of $15 on that Jun800/850.

need a series of things to happen to salvage this by Jun. first a close below 868 in Mar to get max profit from the "rolled" Mar900/950, and then assuming another credit spread somewhere for Apr / May . whats messing this up and what i didn't realize would happen is that the Jun800/850 is not gaining in value as much as i would have thought based on how high the stock went.. with the stock at 900 i would think a 800/850 call spread would be priced near full value but its only going for about $25ish now. the loss of the Feb spread far outpaced the gain of the Jun spread (which tends to happen if the stock moves way past the strikes)

a couple things come to mind when i saw this suggested roll. "risk less make more", "your first loss is your best loss", "don't throw good money after bad" . now having said all that if youre going to do this you need to think thru what to do at Mar Opex..

1. what happens if stock is above 950 (youre new Mar 900/950 gets a max loss and the Jun800/850 will gain some more).. but what do you do then

2. what happens if stock is between 850-868 (between top range of Jun spread and below breakeven of the roll/March spreads expires at max value), are you hoping for just enough gain on the Jun spread to make the whole thing a scratch?

3. what happens if stock goes back under 800 (and now your Jun spread starting losing value)

not a good position to be in. im sticking with my original gut calls on this, was not a compelling trade from the get go, better to take that first loss and exit everything and if necessary reposition yourself using better strikes vs trying to squeeze a scratch out of this one. but really disappointed in the handling of this trade by Mike and the show. we all have losers, we all try to minimize the losses, but this advice is vague , slightly misleading, or at best- selective on the information disseminated. comes with the territory of being trader on CNBC i think. has to suck to get bombarded with the "what do i do now?" "what do you recommend?" type questions but that's also part of the deal. Options Action has always been selective on what trades to cover and noticeably opts out of many losing ones. maybe for ratings. i remember years ago when i paper traded most of the trades displayed and a few of the "regulars" where consistently having losing trades (bricks). scott nations was a master brick layer. hopefully im wrong and all this works on in the right directions to at least breakevens. TSLA is turning into an Options Action widowmaker. comments / alternative trade suggestions welcome

----------------------------------------------------------------------------------------------------

19 feb - crazy that I typed this below on 9 feb …"how does it look if the stock is at 900?"... so caught a tweet from mike today responding to a viewer that followed the trade

i think im doing this right but here goes. (stock 900+ today and Feb opex Friday)

current value the Feb800/850 credit call spread $49+ debit (as in received $12.70 at sale, and would cost $49+ to close) = $36ish loss

current value the Jun 800/850 long call spread $26 (as in collect $26 if closing today, spent $16.25 to enter)= $10ish gain

net net to close the original trade i come up with a debit of $23... you spent $3.60 to put on the trade and would cost $23 more to close it.

mike is saying to roll the Feb short call spread up and out to March but not being specific about strikes..so i looked at the prices of rolling..

Roll option #1 - roll the Feb 800/850 short call spread to the Mar800/850 call spread, that costs $16+ debit to roll

Roll option #2 - roll the Feb 800/850 short call spread UP/Out to the Mar 850/900 call spread, that costs $22 debit to roll

so you see rolling closer to at the money you have to pay more. i really hope im not doing this correctly because its looking like a shitty deal if you followed along. would need stock under 800 on Mar opex to get max profit on the "rolled" call spreads

Option #3 - close the whole thing and take your lumps for $23 debit and move on to the next trade. i will try to roll as often as i need to get back to breakeven (scratch). sometimes doing a slight debit if im also selling the other side.. such has roll the Feb to Mar for the $16 debit AND if i sold a call spread for more than $16 credit.. so the call spread pays for the roll. but $16 to just roll is way out of my range. maybe take the loss and do a review of how you got into this trade and if it meet your criteria from the get go

Option #4 - depends on your conviction for this trade, your account size, and your thesis on where the stock will be on Mar opex… the only way i can see rolling to not pay is to increase the size. ive been playing with a one-lot so if you roll the Feb 800/850 to Mar 800/850 do TWO lots of the Mar800/850. essentially selling an additional Mar800/850 credit call spread.. this roll ONE Feb for TWO Mar lots shows a midpoint credit of $15 using after hours pricing. so now you would have a long Jun800/850 and (2) Mar800/850 short call spreads. tough call to make.

i really hope Options Action hits this one on Friday for an update. Mike normally doesn't have a lot of bricks.

-------------------------------------------------------------------------------------------------------------------------

15 Feb - after a week still not seeing anything compelling. granted the Feb options expires this week so hopefully OptionsAction / Mike does the viewers a solid and updates the management of this trade. when looking after hours this 4leg trade is worth $3.85 debit at midpoint. as in you paid $3.60 to put the trade on last week and to exit would have to pay another $3.85. interested to see how this turns out at Feb opex and with the secondary stock offering announcement

----------------------------------------------------------------------------------------------------------------

9Feb - Options Action show featured another trade for TSLA, have to admit I watched this clip a couple times to wrap my head around it . here is the video clip TSLA clip . even after watching a couple times im not 100% certain as to what Mike wants to happen.

Sell the Feb 800/850 call credit spread for about $12.70 credit (using after hours pricing)

and also

Buy the Jun 800/850 call debit spread for about $16.25 debit

Total debit for the 4leg trade about $3.60 midpoint (super wide bid ask)

Mikes explanation could have used more details since the show tends to be for beginners/intermediate level traders. this trade is similar to a straight up calendar spread, such as sell the Feb800 and buy the Jun 800 but with less premium.

So is mike trying to play the difference in IV between Feb(97ish) and Jun(70ish). as in selling the Feb credit spread since the premium is elevated compared to Jun, as in the Feb spread decays faster than the Jun spread turning that $3.60 debit into a credit (profit) when Feb expires... and that's the whole trade?

or is it sell the Feb spread for the elevated premium, best case it expires worthless AND THEN resell a March 800/850 call credit spread, bring in more premium. premium that is above and beyond that original $3.60 debit and ideally repeat until Jun?

or is the thesis that he is bullish on the stock thru Jun, hence the Jun call spread, and using the Feb call credit spread to help finance it. essentially spending $3.60 for the Jun 800/850

I use etrademonster and will sometimes look at the Analysis Tab and even after that im having a hard time modeling this out as to where I would make money at Feb opex and beyond. Seems to be the ideal would be stock is slightly under 800 at Feb opex, Feb spread expires worthless (you keep the full $12.70) and the Jun spread increased in value. But how does it look if, as Carter mentioned, the blowoff top from this week was the high, how does it look if stock closes at 650 at Feb Opex or how does it look if stock is at 900 at Feb opex. those are extremes I know but no one expected that price action for the last 10 days either. ThinkOrSwim or other platforms may have better modeling but im not getting a comfy feeling on this trade. seems like threading the needle a bit. that feb800 call is a 40delta still ie 40% chance stock is 800 or higher at opex. ive been operating in the 20-30 delta range with good results

would have liked to see more of an explanation as to what scenarios this will be profitable and which ones would be losers. such as max profits on this trade will be XYZ with max loss potential of 123. I will watch this one to see how it turns out and hopefully the show / twitter has an update at / near Feb opex.

I have a position in TSLA , Sold the Feb 505put at $4.20, was 5delta at the time. my thesis is to look for 25-50% of max profit wins to close out. the move in the option pricing are all based on the movement of the stock with not much IV decay. Also a straight up Put Sale if the position is threatened I can roll it out and down for credit easier than any credit spreads. I just check the pricing after hours, that put is $3.30 ish and I could roll it out 2 weeks into a March weekly and down 30+ strikes still for a credit. for my style of trading its a bit more straight forward. will watch mikes trade though, like to see how it turns out, might learn something new

Sunday, February 2, 2020

$DIS Options Action trade alternative

2feb - Tony with an earnings trade on Disney, earnings on 4feb after hours. here is the video clip Disney clip

pretty straight forward by buying a March call spread. stock is 138ish as I type. buying the Mar 130/150 call spread for $5.30. as he said its already 3 dollars in the money. essentially a bullish trade. stock was green on Fridays 2% market selloff but has been hit by the recent virus news and I believe shutdown of theme park in china. so im thinking that the earnings will be all Mandalorian and no virus. virus will be the guidance for next quarter. I would prefer to have the gap fill to 131ish first for a Put sale below the 127 level.

so again, as mainly a premium seller im having a difficult time swallowing a $5.30 debit on the trade despite being the March opex. i always look to limit the price im paying. expected move is near 8 dollars now. Tony mentions the high IV as well. If you have a bullish thesis near term despite the virus overhang instead of paying $5.30 try this calendar spread instead. the expected move gets you to 145-146 level:

Sell the Weekly 149 call at .82 (IV 53)

Buy the March 150 call at 1.85 (IV27)

net debit near $1.00 if you get a generous fill

im thinking the earnings will be good based on the Disney Plus numbers, but caution for the next quarter because of the virus so id expect an initial up move. see the IV difference in the weekly vs the March. if an up move the IV reduces more in the weekly, less in the March. my conviction for an up move is not strong enough to do a Put sale here, would rather see what the reaction is. with my trade if im wrong im only out a dollar vs the $5.30 in tony's trade. but tony would likely close it out prior to full loss. rather risk $1.00 vs $5.30. both trades make money if we get that up move. Risk less make more. For calendars i look to close the whole position within a day or two. i dont try to let the weekly call expire worthless and hold the longer dated one and /or resell another call. if I get the move in my direction I close the win and move on to the next one. whenever I try to get too cute it always costs me. Put this on Tuesday prior to earnings based on where the stock is at that time so you can adjust the strikes.

Monday, January 20, 2020

small win $UNP Options Action Trade alternative- closing

Jan25 stock at 186ish at opex so the you collect the full value of the short put and short call if you held all the way and the May 190 call is nearly unchanged. so about a $200 winner on mikes trade. im sticking with my suggestion #1 from below since the may190 call is unchanged... sell either the May 195 for $4+ or May 200 call for nearly $3 still, to bring in more premium and lower the cost basis. or sell the Feb 190 short call for about $2 in premium turning this into a calendar. don't let this $200 winner turn into a loser. point being the trade is not over just because 2 of the 3 options are not on the board anymore. you have to manage that may190call. you need stock at 196ish at may opex to just be flat with todays results. consider that. im by nature a premium seller so im always trying to limit my debits or bring in credits on trades.

------------------------------------------------------------------------------------------------------------------

Jan20 - haven't seen this trade structure on air before. the sell strangle/buy longer dated call or the sell calendar/ sell put trade. don't follow and have never traded UNP but some comments on the trade. here is the video clip from the show UNP clip

using after hours data on MLK day. stock at 185ish. expected earnings move is $6, Mike is :

Selling the Jan 24 177.50 put (collecting .78)

Selling the Jan 24 190 call (selling the put and call makes is "selling a strangle") - collecting $2.25 total

using that money to Buy the May 190 call for $6.70 (total outlay is $4.45 debit)

$445 is not exactly cheap for a bullish upside call. risk less make more. also discussed by tony was you can consider this selling a calendar(sell the jan24 190 call/buy the may190 call) and selling a put. as I type the IV for the jan24 call is higher than May which is should be but not super elevated. IV for Jan is in the 30's, likely be higher on earnings date. the difference of Jan IV to May IV is less than 20points. does not make me interested in selling premium at all on this stock. for example, NFLX IV is 60+ for the earnings week and 30+ difference to the Apr option.

suggestions:

1. if you absolutely positively have to do this trade, consider also selling the May 200 call for $3 turning that May position into a call spread and reduces the total debit to about $1.45, max profit above 200 in may is $8.55 ($10 from the spread - the 1.45 from debit). you can also sell additional 190 short calls for Feb, Mar for further credits if you get a move higher. remember since you are selling at put, you need that buying power/margin to do that.

2. if you absolutely positively have to do something similar, consider just selling the strangle (if you have the buying power/margin to sell naked calls). don't buy the May call option. Collect the $2.25 premium. your breakeven at opex is 175.25 downside (177.50 put-2.25premium) and 192.25 upside (190call +2.25 premium). you profit in that range. no ifs and or buts, close this strangle the day after earnings. Then if there are compelling results or commentary look to put on something for May opex

3. if you don't have much buying power (enough to sell that put), consider just doing the calendar portion. delete the 177.50 put sale, but will raise your debit to $5.23

4. No trade(my choice). nothing compelling here, not enough premium. Spending $445 per lot does not get my attention. I prefer to be a premium seller or spend minimal dollars for a directional trade. lets see how it works out

Sunday, January 19, 2020

$NFLX Options Action trade alternative-closed

25Jan - first off im going to maintain that I had the right trade. although all trades below were winners im putting an asterick behind mikes. again my focus is to minimize the cost of the trade so a $1100 trade for a one lot is not what im looking at. the general consensus in the "industry" for risk management/capital preservation is that if your long option loses 50% of value you close it out. like a having a stop with stock. that's the discipline. I did a call butterfly very similar to my recommendation below and sold a cash secured put/sold call spread so I had skin in the game as well. thought is saw the 340call at $3-$4 at one point when stock was near 325 after earnings. if you didn't cash out at some point and held to the very end of the week you had profits. my call spread suggestion below had more. my suggested call fly was at +350% at one point as I was trying to milk for more. ended up closing for chump change in the last hour. the expected move was about $26. that's 26 either way up until opex, not immediately after earnings. so for this instance the move was less than priced. ie the premium sellers were the winners. stock was near 353 at close so will credit mikes trade with a $300 win. the high was 359ish so its close enough to say its a gap fill. that 360 area functioned as resistance as expected

here is the link for the NFLX clip NFLX 24jan

--------------------------------------------------------------------------------------------------------------------

18Jan - on the 17Jan show Mike Khouw with a trade for Netflix ahead of Tuesday earnings. here is the video clip NFLX clip

I haven't traded NFLX in ages but have had good trades on ROKU. both stocks move together. Netflix is hanging in despite all the competition coming online. is NFLX at the point where it doesn't go down on bad news? to the trade... hard to swallow that $1100 for a call option. stock at 340ish now. for earnings I generally assume that the options market has everything priced correctly. meaning the expected move is about accurate. not always but its something to base off of. the expected move for NFLX is about 23bucks now (add the 340put and the 340call together). so that gets you to about 315ish and 365ish. note on the chart and as Tony mentioned in the clip that there is a gap at 360.

so with a bullish thesis, the expected move, and the gap fill/resistence at 360 instead of spending $1100 on the

Mikes trade:

Buy Jan24 340 call for $11 (its 12.70 now after hours) - need 351 or higher at opex to be profitable. seems exactly opposite of what the show has been preaching previously.. the risk less, make more... the buy call spreads vs just calls when premium is high.

My alternative to Mikes trade:

Buy the Jan 340 call for $12.70 and sell the 365 call for $4.30 = $6.70 debit instead. - breakeven at 346.70 . max profit at 18.30 if at 365 or higher at opex

MarkLexus trade suggestion bullish:

if bullish, if expecting the expected move to be generally accurate, if expecting the 360gap fill and resistance at 360 then instead:

Buy the Jan 24 350/360/370 call butterfly (buy 350call,sell two 360calls, buy 370 call) - can probably get a fill for $1.00. heres the reasoning... mike needs at least 351 to be at breakeven, my call fly needs 351 for breakeven. the center of the call fly is at 360 which is the resistance mentioned. my profit range is 350-370ish. yes at 370 I make zero and mike has big win but that initial $1100 price is the dealbreaker for me. I will gladly sacrifice the "big winner" for a 1/10th cost bullish position. my call fly has max profit of $900 if at 360pin. I guess you could do an 11 lot if you have to absolutely spend $1100. that would be $9900 for a 360 pin.

point being for a directional trade i want to commit minimal dollars.

my call fly - $1.00

my mike alternative - $6.70

mikes - $11

lets see what happens at the end of the week.

Sunday, January 5, 2020

$AAPL Options Action trade alternative

3 Jan Options Action show has Mike essentially selling a covered call on stock you own. here is the clip AAPL clip

Selling the Feb 315 call for $6.00 stock at 298-300ish

what mike is saying is all correct. where I differ in strategy is that this call expires in 47 days. so you will have time decay during that period. BUT earnings are on Jan28 and as we all know IV increases into earnings mainly on the weekly options of that earnings week and not as much for the time periods after it. point being the increase in IV (the price) of this call will offset much of the time decay. as in you are not getting much decay between now and Jan 28 if stock is sideways

I would prefer to sell the Jan24 short call either 315 or 312.50 to get $1-$2. get some premium and or allow the stock to work higher, THEN sell another short call for the Jan31 opex based on where the stock is at the time. Mike went to a 30delta on this one so go with that as well. THEN sell something in Feb.

bottom line I feel like im not getting the decay in selling a Feb option right now. both will work im sure but I want to take advantage of the IV increase on that Jan 31 options. selling a Feb now feels like im leaving money on the table for 2months.

for the purpose of this alternative against long stock:

Sell the Jan 24 312.50 for $2.00 (midpoint price after hours) 20delta, 19days till opex

Subscribe to:

Posts (Atom)